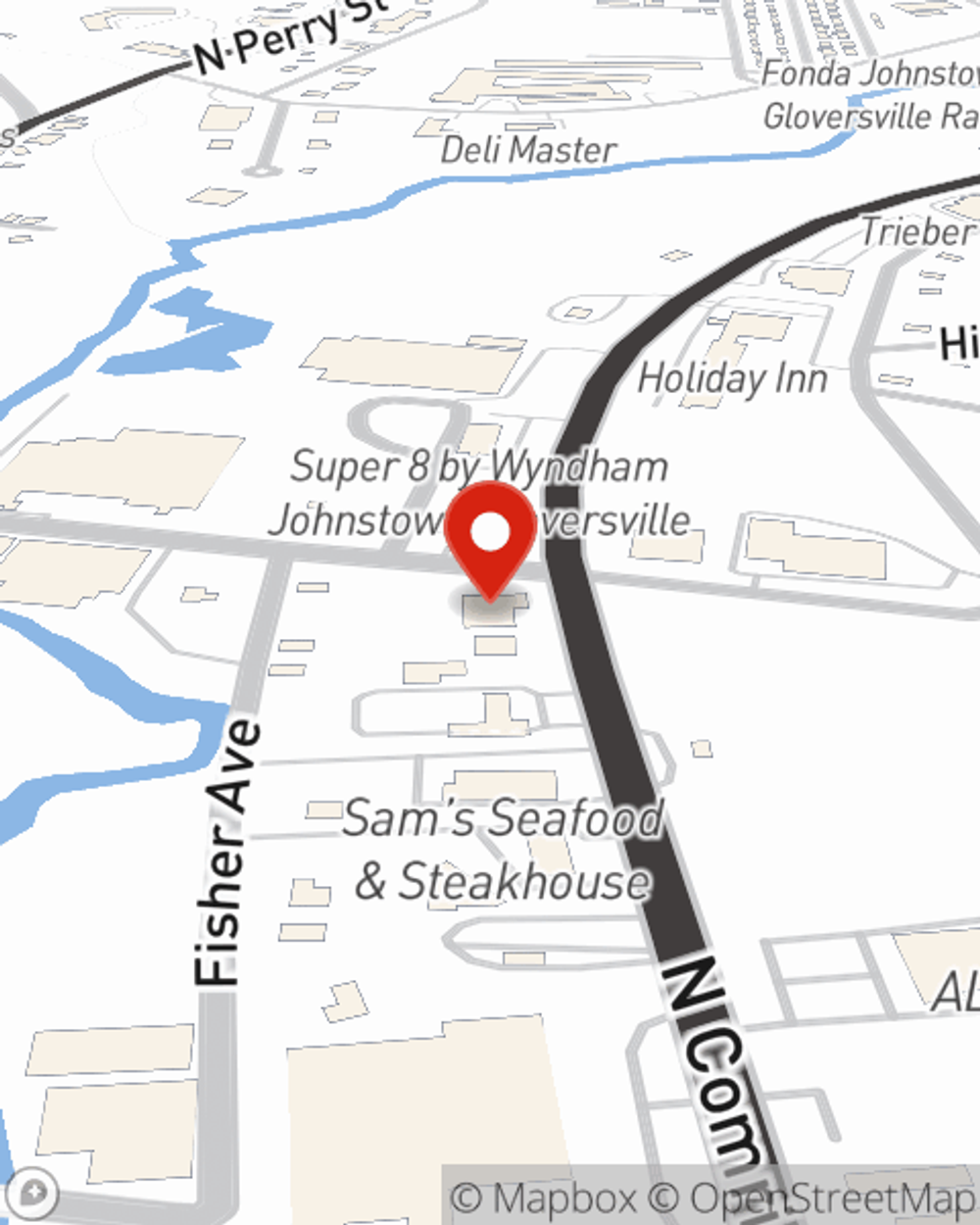

Business Insurance in and around Johnstown

Researching coverage for your business? Search no further than State Farm agent Mickey Parker Jr!

No funny business here

- Johnstown NY

- Philadelphia PA

- Hershey PA

- Gloversville NY

- Amsterdam NY

- Fulton County NY

- Albany NY

- Schenectady NY

- Ballston Spa NY

- Fonda NY

- Fultonville NY

- Pittsburgh PA

- Allentown PA

- Little Falls NY

- Utica NY

- Cobleskill NY

- Schoharie NY

- Altamont NY

- Saratoga Springs NY

- Clifton Park NY

- Niskayuna NY

- Colonie NY

- Syracuse NY

- Rome NY

Business Insurance At A Great Value!

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide quality insurance for your business. Your policy can include options such as business continuity plans, worker's compensation for your employees, and extra liability coverage.

Researching coverage for your business? Search no further than State Farm agent Mickey Parker Jr!

No funny business here

Protect Your Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Mickey Parker Jr for a policy that safeguards your business. Your coverage can include everything from business continuity plans or extra liability coverage to group life insurance if there are 5 or more employees or employment practices liability insurance.

Call Mickey Parker Jr today, and let's get down to business.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Mickey Parker Jr

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.